Business insights of Trident Group

A deep dive into the business model of Trident Group

About

Trident, formerly known as Abhishek Industries Limited, is the flagship company of the Trident Group. Established in April 1990, it is renowned as one of the largest towel manufacturers globally. It is a major agro-based paper manufacturer and yarn producer in India.

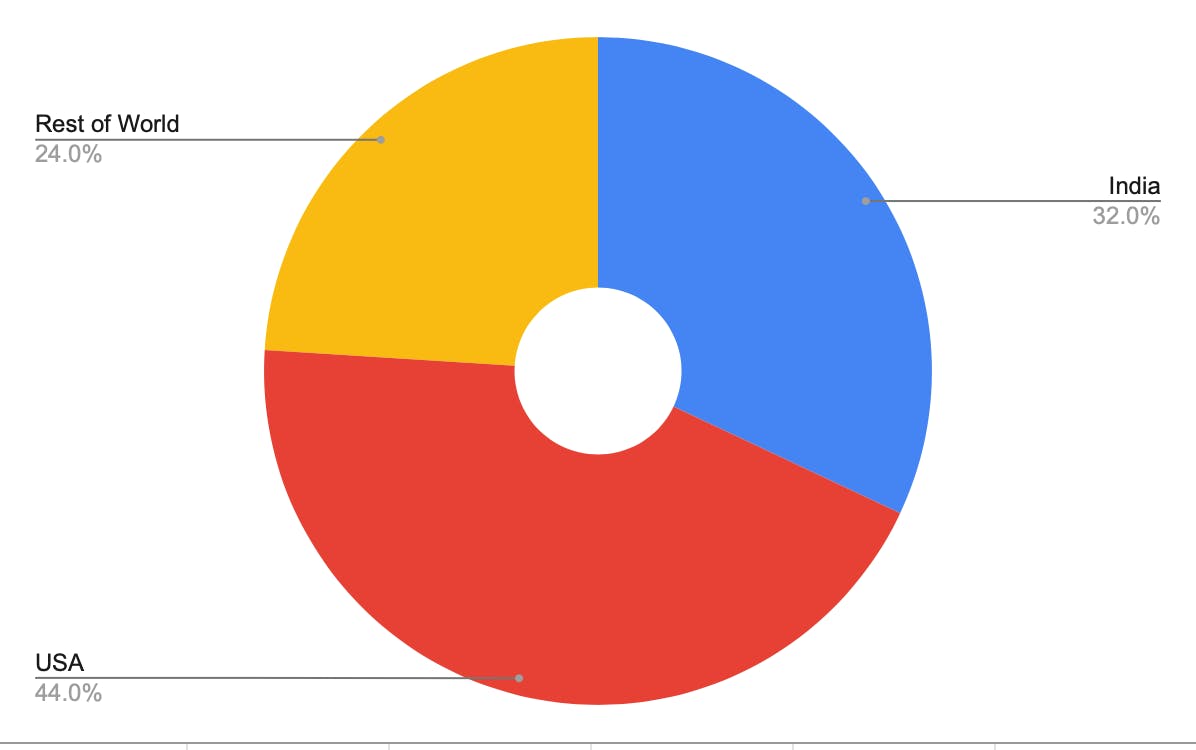

The Trident Group is a prominent diversified business conglomerate in India, led by the visionary chairman Mr Rajinder Gupta, a first-generation entrepreneur. Starting with just 17,280 spindles of yarns, the company has expanded significantly and now exports to over 75 countries. The group remains committed to maintaining its position as one of India's largest yarn producers while striving for continuous growth.

Overall Business

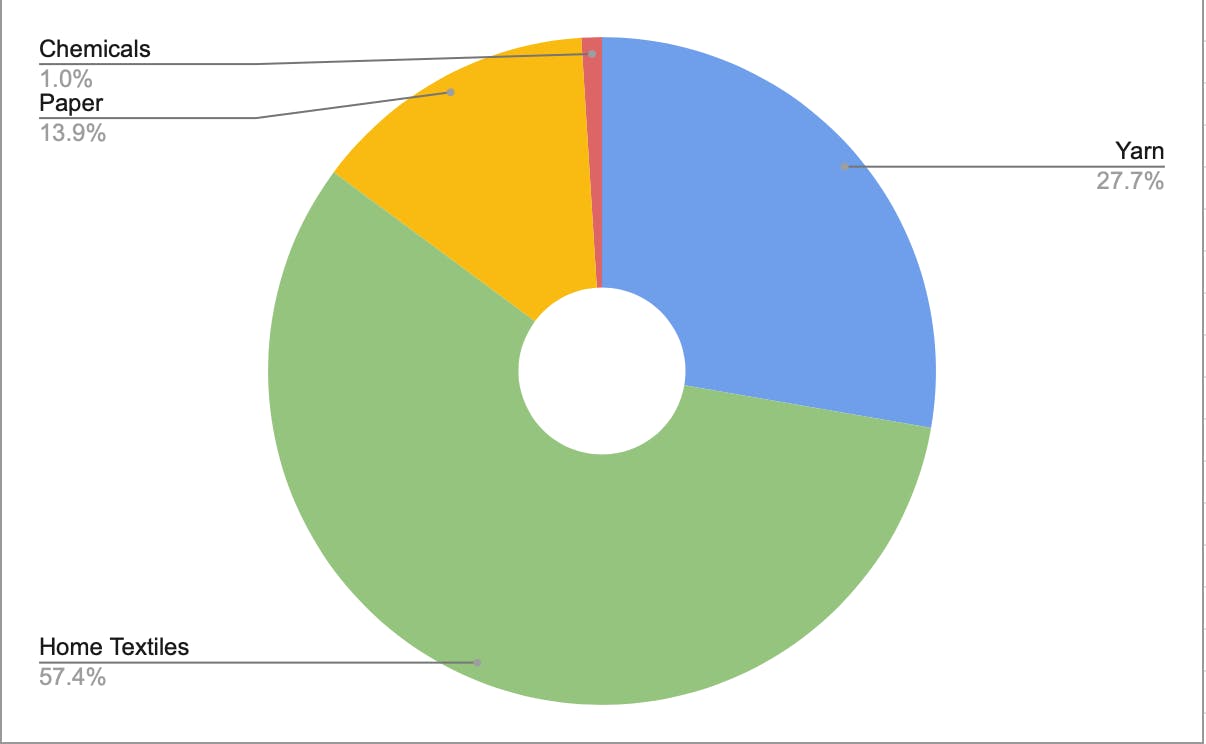

Trident operates through four primary business segments:

Yarns

Terry Towels

Paper

Chemicals

The company serves diverse markets, including Brands, Department Stores, Home Specialty Chains, Mass Merchants, and Institutional Customers. Our customer base includes renowned retail giants across the US, Europe, Australia, and New Zealand, and we are rapidly expanding into markets in the Middle East, Japan, and South Africa.

Yarn Business

The Yarns segment offers a wide range of products, including 100% cotton yarns in Grey, Dyed, and Mercerized options, as well as Single & TFO Doubled, Hosiery & Weaving (Combed & Carded), Poly Cotton blended yarns, and 100% Poly Spun Yarns (Combed & Carded). Additionally, the segment also provides 100% Egyptian Cotton Yarns, 100% PIMA Cotton Yarns, Organic Cotton Yarns, 100% Water Soluble PVA Yarns, SLUB Yarns, Combed and Semi-Combed Knitting and Weaving Yarns with a Count range of 10-30, Polyester Spun Knitting and Weaving Yarns with a Count range of 30-40, Dyed and Mercerized Double and Processed Yarns, and Water Soluble 100% PVA Yarns with a Count Range of NE 30 to NE 80.

Terry Towel Business

The Terry Towels segment provides an extensive range of products, such as Piece-dyed dobbies, Yarn-dyed single and double jacquards, Uni-dyed jacquards, Yarn-dyed stripes, Weft inserts and checks, Terry and velour finish, Beach towels, Bath sheets, bath towels, and bath mats, Hand towels, Guest towels, Face fringes, Kitchen towels, Printed towels, and Embroidered towels.

Paper Business

The Paper segment offers a diverse range of products, including Spectra Copier - Ultra-finish, high-speed Copier Paper in two varieties - 75 GSM with a brightness of 88% ISO and 80 GSM with a brightness of more than 90% ISO, Goldline Surface Size Maplitho - 54 GSM to 90 GSM with brightness 90% + ISO, Silver Surface Size Maplitho - 54 GSM to 90 GSM with brightness 88% ISO, Super White Maplitho (54 - 90 GSM with 88% ISO Brightness), Ivory White Paper (54 - 90 GSM with 85% ISO Brightness), Eco-Print Paper (54 - 90 GSM with 80% ISO Brightness), Base Paper (80 - 90% ISO Brightness), Bible Printing Paper (45 - 50 GSM with 90% ISO Brightness), and Watermark Offset Printing Paper (54 - 90 GSM with 80 - 90% ISO Brightness).

Chemical Business

The Chemicals segment offers specialized products to meet the evolving industrial requirements. The company has entered the Battery Grade Sulphuric acid market, a superior quality product. In addition to catering to high-end consumers, the company also manufactures Commercial Grade products to capture a larger market share. The clientele for these products includes prominent battery manufacturers and other specialized consumers.

Revenue Split Up

Geographical Presence of Trident

Financials of Trident

Financial Statements of Trident

Goal

The company unveiled 'Vision 2025', a comprehensive strategy aimed at enhancing the company's standing in all business sectors. The plan targets a revenue of Rs 25,000 crore and a 12% increase in the bottom line by 2025. Additionally, the objective is to establish Trident as a national brand and fully digitalize the company by completing the Industry 4.0 or smart manufacturing journey.

Conclusion

Consistent growth in the top line of the company.

Stable OPM years but declined due to global market conditions.

ROE above the industry.

Increase in promoter holding from 71.06 to 72.94

Currently, stock price crashes due to excess runoff during the covid market recovery.

Positive cashflow

Consistent growth in reserves and surplus

Low debt-to-equity ratio

The biggest player in the segment

Decrease in inventory days

Disclaimer

Any information or communication I provide is for educational or informational purposes only and should not be construed as investment advice. It is important to conduct your research and seek the advice of a professional financial advisor before making any investment decisions. Any investment you make is solely at your own risk, and I am not liable for any losses or damages that may occur as a result of your investment decisions.